To provide you with the best possible user experience, we use cookies and similar technologies. These include cookies for the operation and optimization of the website and for advertising tailored to your online usage behavior.

Purchasing a Shelf Company in Germany: Pros, Cons, and How to Proceed

When considering doing business in Germany, entrepreneurs often face the decision of whether to start a new company from scratch or purchase a shelf company.

This article delves into the various types of shelf companies available, who can benefit from this option, the crucial role of a proxy director in Germany, the advantages and disadvantages, the step-by-step process of buying a shelf company, legal limitations to be aware of, and the associated costs. By the end of this guide, you’ll have a comprehensive understanding of whether buying a shelf company is the right choice for your business venture in Germany.

Table of Contents

- Introduction

- Types of Shelf Companies in Germany

- Who Benefits from Buying a Shelf Company?

- The Significance of a Proxy Director in Germany

- Advantages of Purchasing a Shelf Company

- Disadvantages to Consider

- How to Buy a Shelf Company

- Limitations and Legal Considerations

- Costs Involved

- Conclusion

- Frequently Asked Questions

Types of Shelf Companies in Germany

Shelf companies in Germany come in different forms, including:

- Aged Shelf Companies: These companies have been registered for a longer period and may have an established financial history.

- Shell Companies: These are entities with no trading or operational activity but can be quickly adapted for various purposes.

- Special-Purpose Companies: Some shelf companies are designed for specific industries or sectors, such as real estate or technology.

Who Benefits from Buying a Shelf Company?

Buying a shelf company can be advantageous for several parties, including:

- Foreign Investors: Entrepreneurs looking to establish a presence in Germany without the delays of incorporating a new company often opt for shelf companies.

- Time-Sensitive Ventures: Businesses that need to commence operations swiftly can benefit from the ready-made structure of shelf companies.

- For Risk Mitigation: Purchasing an established company can help mitigate startup risks associated with new ventures.

The Significance of a Proxy Director in Germany

Proxy directors play a critical role when purchasing a shelf company in Germany. They serve various essential functions:

- Local Representation: Proxy directors provide a physical presence for the company in Germany, ensuring it complies with legal requirements.

- Administrative Duties: They handle administrative tasks, including tax compliance and regulatory obligations.

- Legal Affairs: Proxy directors ensure smooth legal operations and assist with legal matters as needed.

- Banking: In Germany, to open and operate a bank account for the company, it is often a requirement to have a German resident associated with the account. The proxy director fulfills this crucial role, serving as a local representative who meets this requirement.

Clevver, Your Partner for Shelf Companies in Germany

Specializing in Shelf Companies and Company Incorporation services in Germany, Clevver provides comprehensive support to navigate the country’s intricate system. Our Team expertise extends to handling of Company registration, Tax and accounting services, and ensuring compliance with the rigorous German accounting standards.

Moreover, we offer Virtual Offices in Germany and worldwide, inclusive of Legal Addresses and Digital Mailboxes.

Advantages of Purchasing a Shelf Company in Germany

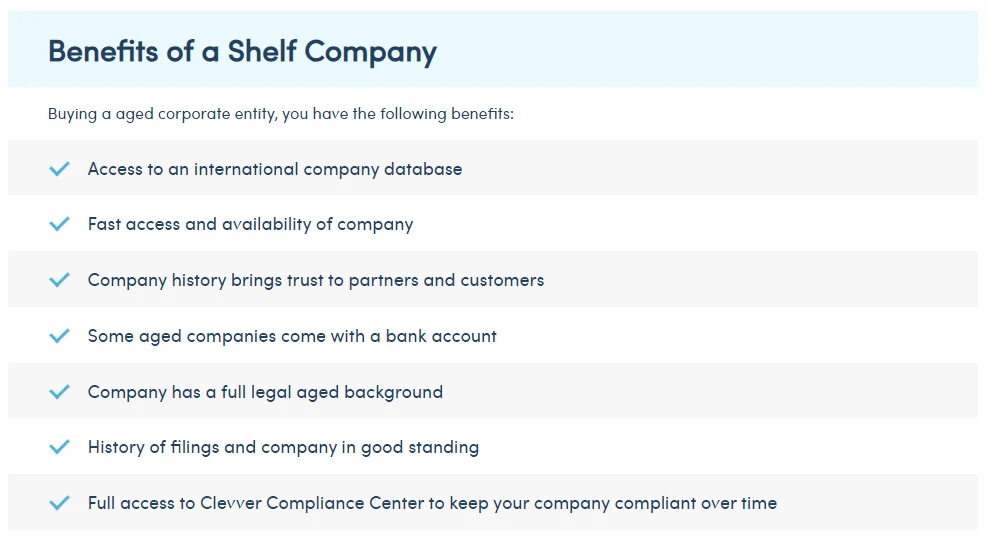

Acquiring a shelf company offers several benefits, including:

- Immediate Market Entry: Shelf companies enable you to start operating in Germany immediately, bypassing the time-consuming process of establishing a new company.

- Established Reputation: Some shelf companies come with an existing reputation, which can be beneficial for attracting clients, partners, and investors.

- Financial History: Access to financial records allows for better financial planning and potential investor trust.

- Lower Startup Risks: Established companies typically have fewer unknowns, resulting in lower startup risks.

Aspects to Consider

While purchasing a shelf company has its advantages, it’s essential to consider the following disadvantages:

Higher Initial Cost: Shelf companies come with a price tag, which can be higher than the cost of starting a new business from scratch.

Inherited Liabilities: You may inherit existing liabilities or legal issues associated with the company.

Limited Customization: Established companies may have existing structures and processes that may not align with your vision.

How to Buy a Shelf Company in Germany

The process of buying a shelf company typically involves the following steps:

- Research: Identify a suitable shelf company that matches your business objectives.

- Due Diligence: Conduct a comprehensive review of the company’s financial records, contracts, and legal status.

- Negotiation: Negotiate the terms of the purchase, including the price and any necessary conditions.

- Transfer of Ownership: Formalize the purchase through legal contracts, including a share purchase agreement.

- Appointment of a Proxy Director: Appoint a proxy director to handle local administrative and legal matters.

Limitations and Legal Considerations

Purchasing a shelf company in Germany has certain limitations and some legal aspects should be taken in considerations:

- Regulatory Compliance: Ensure that the purchased company complies with all German regulations, including tax and business laws.

- Name Change: If you wish to change the company’s name, this process must adhere to German naming regulations.

- Share Capital: Be aware of the share capital requirements and ensure they are met.

Costs Involved in purchasing a ready-made company in Germany

The costs associated with purchasing a shelf company can vary but generally include:

- Purchase Price: This is the initial cost of acquiring the shelf company, which varies based on the company’s age, reputation, and financial standing.

- Legal Fees: Legal professionals will assist with due diligence, contracts, and compliance, incurring legal fees.

- Proxy Director Fees: Proxy directors charge fees for their services, which can vary depending on their role and responsibilities.

- Additional Costs: There may be other expenses such as notary fees, registration fees, and taxes.

Conclusion

Purchasing a shelf company in Germany offers a streamlined way to enter the market, benefit from an established reputation, and reduce startup risks. However, it’s essential to weigh the advantages and disadvantages carefully, ensure legal compliance, and budget for associated costs. For entrepreneurs seeking a swift and efficient entry into the German business landscape, buying a shelf company can be a strategic choice.

Shelf Companies in Germany – Frequently Asked Questions

Can I change the name of a shelf company I purchase in Germany?

Yes, you can change the company’s name, but it must adhere to German naming regulations.

What are the typical legal costs involved in buying a shelf company?

Legal costs can vary but often include fees for due diligence, contracts, and compliance services.

Is it possible to customize the operations of a shelf company to align with my business vision?

While some customization is possible, established companies may have existing structures and processes that can limit full customization.

What types of liabilities should I be cautious of when purchasing a shelf company?

You should conduct due diligence to identify any existing liabilities or legal issues associated with the company, which you may inherit upon purchase.

Are there specific regulations regarding share capital when buying a shelf company in Germany?

Yes, there are share capital requirements that must be met, and they can vary based on the type and age of the shelf company.